THE PROBLEM:

Ohio is in the midst of a compounding crisis with a severe shortage of affordable housing for poor and working-class households. In 2020, only three of the 10 most common jobs in Ohio paid the hourly rate necessary for a worker to afford a modest, two-bedroom apartment. ¹This causes a significant rent burden not only among Ohio’s lowest income but also moderate-income renters across the State. ²Due to this shortage of affordable rental housing, nearly 400,000 households in Ohio have a severe cost burden, spending over half their income on rent. 90+% of renters who make under $22,750 are rent burdened; 73% of renters who make between $22,750 and $37,900; and 30% of renters who make between $37,900 and $60,650 annually.²’³

BACKGROUND:

Today, the largest driver of affordable housing development nationally is the federal Low-Income Housing Tax Credit (LIHTC) program, a bipartisan public policy incentive that has driven outcomes through private sector investment and development. In Ohio, more than 100,000 affordable housing units have been developed through the federal LIHTC program. The federal LIHTC comes in two forms: the 9% and 4% credit. Projects utilizing the 4% credit are financed in part with tax-exempt bonds. Each year, $120 million of federal bond volume cap is allocated to Ohio for multifamily development, but a lack of additional leveraging funds has left this substantial federal resource untapped to Ohioans since 2015. In order to change this, additional funding sources like the state credit would leverage this substantial federal resource to the tune of $200-300 million and generate even more viable affordable housing development and economic impact in our state.

THE SOLUTION:

THE OHIO AFFORDABLE HOUSING TAX CREDIT PROGRAM

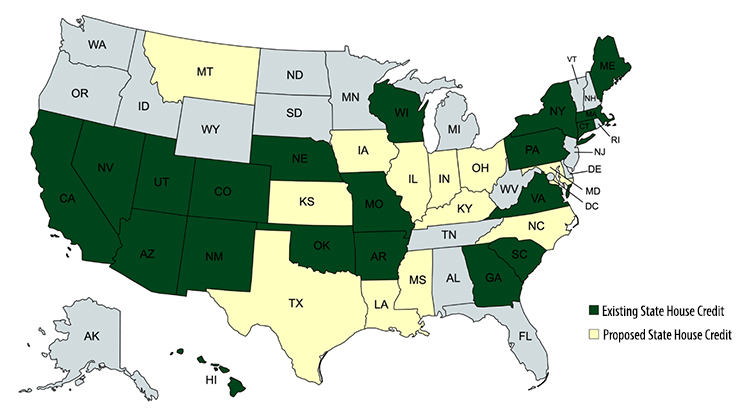

At present, 20 other states (and growing) have effectively utilized state housing tax credit programs as a mechanism to provide a state- level funding to draw down these federal resources to meet affordable housing needs. This bill will create an Ohio Affordable Housing Tax Credit leveraging the existing federal housing tax credit – the primary tool Ohio will utilize to drive creation of affordable workforce, family and senior housing through private investment. In addition, this credit will have an immediate, profound economic development impact on Ohio communities years before the state issues the credit.

H.B. 560: (Representatives Hoops, Pavliga)

- State investment of $50 million in annual credits, issued over 10 year period.

- 6 year sunset spanning FY 2022 through 2027.

- Available for 4% and 9% LIHTC transactions.

ECONOMIC & FISCAL IMPACT:

Affordable housing development is a proven driver of economic development, job creation, and tax revenue.

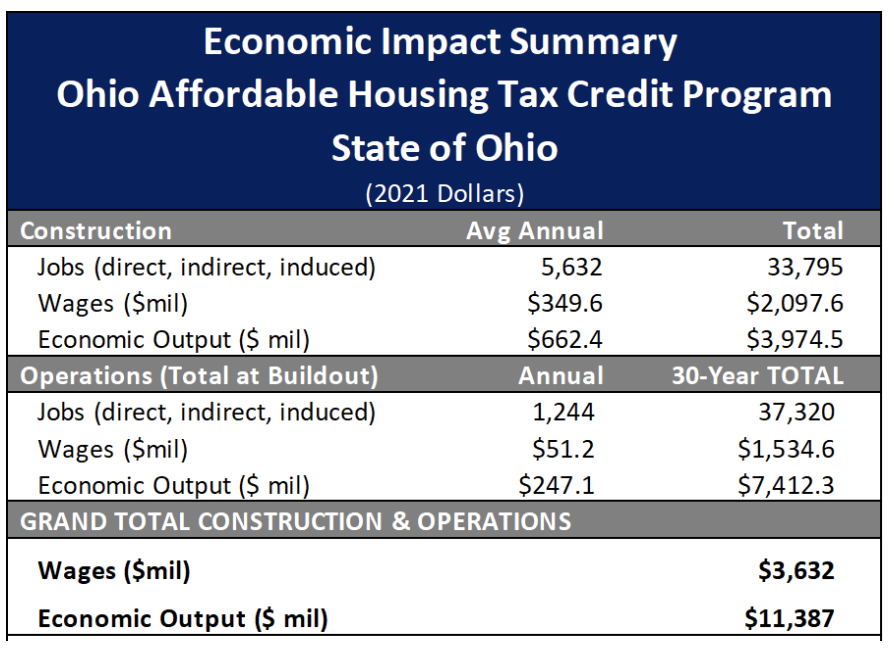

New Units: This program is projected to yield approximately 2,300 new units annually, a total of 13,800 new units over 6 years.

Jobs: Construction of the new housing units will create: 5,632 jobs in each year of the program; 33,795 over 6 years;

$2.1 billion in wages; and over $4.0 billion in job-related economic activity throughout the state.

Economic Activity: In total, both construction and property operations will create nearly $11.4 billion in economic activity over the course of construction and 30 years of operations.

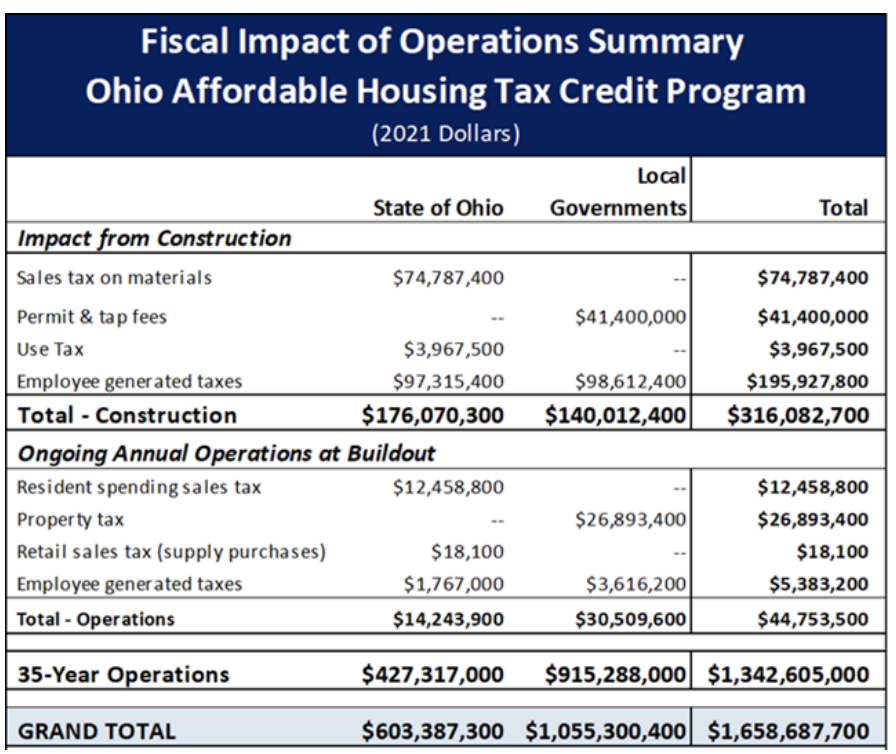

Tax Revenues: Combined, construction and operating tax revenues of the program would total over $1.7 billion

in tax revenue to state, county, and local governments.

CONCLUSION:

This program would not only stabilize vulnerable households, and thereby relieve pressure on other social systems, but would also open the door to significant federal resources, and allow leveraging of substantial private equity investment to meet Ohio’s unmet housing needs. Not only that, but housing development creates jobs, stimulates economic growth, and boosts state and local tax revenues. Successful outcomes in other states clearly demonstrate that state credit programs make good policy and business sense.

Supporting Data

¹https://reports.nlihc.org/oor/ohio. The hourly rate referenced is $15.99/hour.

²https://ohiohome.org/news/documents/2020-HNA-ExecutiveSummary.pdf

³https://ohiohome.org/compliance/documents/incomelimits_HOME20.pdf. Incomes vary by region, but incomes cited for illustration purposes are those for a 3-person household in the Columbus region. Extremely low-income households (ELI) are defined as those with incomes at or below the poverty guidelines or 30% of their area median income (AMI). 437,765 or 27% of all Ohio households fall into this group.